8a Certification: Everything You Need To Know

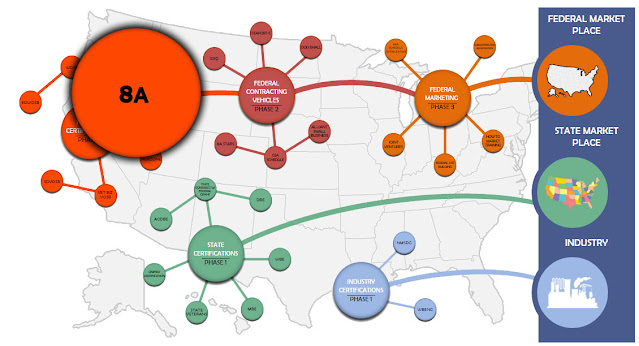

8a certification is a kind of license or certification that can be hold by a company or an organization. A company that has received an 8a certification is supposed to be involved in the 8(a) Business Development Program. To find out more about 8a (Minority Owned Small Business) certification, we can also search for US Small Business Administration or SBA. According to the SBA, the 8a Business Development Program that is officially known as the "8(a) Business Development Program" satisfies the federal government's requirements to pay small, underprivileged firms, 5 percent or more of contract money. This government assistance programme helps underprivileged US individuals run small companies. There are several advantages to 8a certification when persons who are both financially and socially challenged own and manage 51 percent or more of a business.

Many aspiring business owners are able to get government contracts by earning their 8a certification. The 8a Business Development Program is a key chance for small business owners who are financially and socially underprivileged. According to the government Minority Business Development Agency or MBDA, it allows many people access to the financial mainstream of American community. With 8a certification that is meant for the minority owned small business, you may get financial support, learning, training, surety insurance, business counselling, and other technical and administrative support.

Benefits of 8a Certification

You can get 7 types of benefits primarily if your business has 8a certification. These are:

- With this 8a certification both the competitive and sole-source set aside contracts can be accessed by you.

- You can participate in partnership bids through the mentor-protégé programme, that allows to you to have access to larger contracts. Mentorship from more established companies is another option.

- You will have access to a wide range of consultancy services to enhance the growth of your company. These include business consulting, specialised training, high-level leadership skills, and marketing assistance. The SBA's resource associates and the organisation itself both offer these services.

- You will get a Business Opportunity Specialist to serve as your guide through the federal contracting process.

- The federal government frequently has extra supplies and assets. You too can seek benefits in gaining access to such surplus assets only if your business has an 8a certification.

- You can avail support in case of bonding.

- 8a certification makes you eligible for loans that are guaranteed by the SBA.

What will you require to get the 8a certification for your company

In the 8A Certification eligibility criteria, you will get to know about the qualities or standards you must follow if you want to be approved for 8a certification. For the time being, let's talk about the 8a program's requirements, which are meant to support the goal of assisting disadvantaged businesses in becoming successful:

- You must agree to the procedure in order to take part in the 8a certification programme. That indicates that you want to be evaluated and followed up on by the SBA in order to track your development and confirm your loyalty to the rules. That requires submitting to yearly assessments, thorough assessments, and company planning consultations.

- A business with an 8a certification cannot receive sole-source contracts for more than $100 million or five times the value of its main NAICS code.

- Businesses participating in the 8a programme must show that they are managing government and commercial initiatives in a balanced way.

Eligibility criteria for 8a Certification

Here is a brief checklist to check if you are eligible for the 8a Certification:

- You should meet the SBA's size guidelines and the government definition of a small company.

- If you have never taken part in the programme before.

- You can possess a minimum of 6 million dollars in personal belongings, $750,000 in individual net worth, and $350,000 in adjusted gross earning.

- Your company should be owned and managed at least 51 percent by one or more individuals who are financially and socially challenged.

- Your business or company should typically belong to one of the following groups: African Americans, Native Americans, Hispanic Americans, Asian Pacific Americans, or Asian Americans from the Subcontinent. If not, they can clearly show social disadvantage due to their gender, impairment, racial background, continuous exclusion from general society, or other factors.

- You have to show promise for success, often by having been in a company for at least two years. Display a solid set of morals and the capacity to carry out your commitments under contracts.

The local DPCE generally take 15 days to review your application strictly to complete. If the SBA finds that further information is required, you will have 15 days to submit it. After then, the application returns to your local DPCE. Within one and a half month of your application being completed, the SBA must either accept or reject it. The expansion of your company may be pushed by 8a certification, and the experience might be irreplaceable. You can get a Government Procurement Adviser at Select GCR to assist you in navigating the complex federal government contracting system.

Comments

Post a Comment